Poonawallafincorp.com CPL - India

Offer Details: | |

|---|---|

| Offer Name: | Poonawallafincorp.com CPL - India |

| Payout: | ₹262.50 / cpl |

| Preview: | Preview Landing Page |

| Categories: | loan |

| Network: | vCommission |

| Last Updated: | Jul 27, 2025 |

| Countries: | IN |

Name: Poonawallafincorp.com CPL - India

Channel: Web+mWeb

Operating System: Windows, MacOS

Incentive: Non-incent

Conversion Type: CPL

Vertical: Lead Gen

Category: Loan

Description: Poonawalla Fincorp is a non-banking finance company (NBFC) that provides consumer and MSME financing.

Conversion Flow:

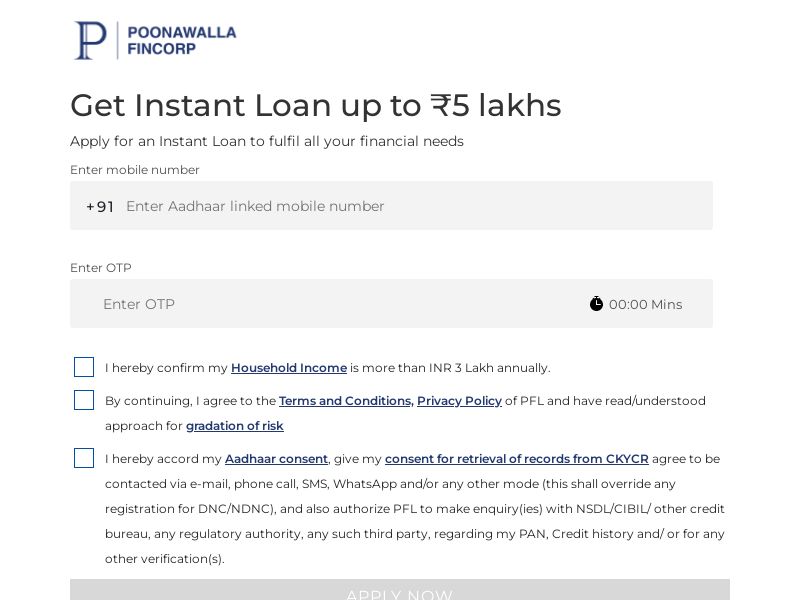

* User clicks on the tracking URL

* User fills the Mobile No. along with OTP

* User fills Personal Details, which include Pan card, DOB and address

* User confirm the pan card

* Once the Cibil is fetch, user get the congratulation page

* Tracked on client CRM & report will be imported in every 24 hours

* Payment will be made only for conversions meeting KPI

Tracking Information:

Frequency - Offline

Cookie Duration - 30 Days

Web - Available

Mobile Web - Available

On Page Verification: Mobile OTP

Report Frequency: Daily

Validation Period: 30 Days

Promotion Methods:

Content - Allowed

Coupon - Not Allowed

Cashback - Not Allowed

Mobile App - Not Allowed

Email - Allowed

SMS - Allowed

Telegram - Not Allowed

Influencer - Not Allowed

Software - Not Allowed

Media Buying : Search - Allowed

Media Buying : Social - Allowed

Media Buying : Native - Allowed

Media Buying : Display - Allowed

Sub-Network - Allowed

Pop - Not Allowed

Push - Not Allowed

Video - Not Allowed

Reseller - Not Allowed

Incent - Not Allowed

Smartlink - Not Available

SUB1: Lead ID

SUB2: NA

SUB3: NA

SUB4: NA

SUB5: NA

Payout: INR 262.5/Qualified Leads

Payout as per Disbursal model (CPD): User will be eligible for this payout if disbursal comes

| Disb Amt Per Month | Payout Slab - STPL | Payout Slab – Prime PL |

| 0 to 4.99 Cr | 1.92% + GST | 2.45% + GST |

| 5 to 7.5 Cr | 1.99% + GST | |

| 7.51 to 10 Cr | 2.10% + GST | |

| 10.01 to 19.99 Cr | 2.27% + GST | |

| 20 to 30 Cr | 2.38% + GST | |

| > 30 Cr Above | 2.45% + GST |

Detailed KPI:

1. Geo Targeting: Pan India excluding Jammu & Kashmir, Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland and Tripura

2. PFB the Audience Targeting

| Particulars | STPL (Short Term Personal Loan) | PrimePL (Prime Personal Loan) |

| Interest rate | Starting 16% to 36% | Starting 12.65% |

| Eligibility Age | 25 to 55 | 23 to 58 yrs |

| Cibil Score | Above 720 | Above 720 |

| Citizenship | Indian | Indian |

| Monthly Income - Salaried / Self Employed | 25,000 and above | 30,000 and above |

| Minimum Loan Amount | 50 k | 1 Lakh |

| Maximum Loan Amount | 5 Lakhs | 15 Lakhs |

| Average Ticket Size | 2.1 Lakhs | 3.5 Lakhs |

| Work experience | - | Minimum 1 year, with at least 1 month in the current company |

| Tenure | 12-36 Months | 12-84 months for applicants above 28 years |

| Location | Pan India excluding J&K, 7 sisters | Specific 10k zip codes and 37k organizations |

vCommission

vCommission is an Internation CPA Network based out of India. They work on high quality advertising and generating quality traffic for their affiliates. They have many effective marketing programs for their affiliates to choose from. They have over 300 offers running right now and this number is only expected to go up in the near future. Despite having so many offers, vCommission gives each affiliate a high level of attention ensuring that you have all the tools necessary to succeed in affiliate marketing.